The pilot shortage is a complex issue. This is a comprehensive analysis of the shortage of pilots examining pilot supply and pilot demand. It includes original research, statistics and charts showing the urgent need for pilot training and the value in become an airline pilot.

|

In Brief: There is an acute pilot shortage of qualified pilots. All the evidence lead us to believe there will continue to be a global pilot shortage for at least the next 10-20 years and it is going to be severe. This is an opportune moment to begin career as a pilot. The demand for skilled pilots is projected to increase significantly over the next few years. Flight schools and training institutions need to amplify their efforts to produce well-trained pilots to meet this demand. With mandatory retirement and air travel demand growth, a pipeline of new pilots is crucial to maintain the pilot population for the sector but is imperative to maintain global connectivity and growth. It's been 3 years since we last wrote about this, and as we said at the time: |

|

Still have Questions? Are you wondering:

- How do you know there is a shortage of pilots?

- How big is the pilot shortage?

- When will the pilot shortage end?

- What are the reasons for the pilot shortage?

- Why can’t existing pilots just fly more?

- How is the pilot shortage affecting pilot salary and compensation?

Flex Air trains people with no flight experience to become airline pilots, so we get a lot of questions about pilot demand, pilot supply, the 2023 pilot shortage and what we think the future pilot shortage will look like. Here is our comprehensive insight into the pilot shortage including our own analysis, and that of the pilot shortage statistics, and the reasons for it.

We read all of the following analysis on the airline pilot shortage, so you don’t have to:

- FAA Aerospace Forecast Fiscal Years 2023–2043

- Boeing Pilot and Technician Outlook 2023–2042

- IATA Global Outlook for Air Transport June 2023

- ALPA Debunking the Pilot Shortage Myth

- The Oliver Wyman Analysis (Jan 2023, Jul 2022, Mar 2021)

- Fortune’s coverage of the Airline Industry including various airline earnings calls and congressional testimony.

- United Airlines Holdings Inc. (UAL) Q4 2022 Earnings Call Transcript

How do you know there is a shortage of pilots in 2023?

In April 2020 Faye Malarkey Black, president and CEO of the Regional Airline Association testified at a meeting of the House Committee on Transportation and Infrastructure. She said the aviation industry is facing a “devastating pilot shortage” and limiting its ability to meet demand of passengers.

The FAA requires commercial airline pilots to retire at age 65, leading to a growing workforce shortage as pilots continue to age. Black stated that in the next 15 years, half of the pilot workforce will retire, triggering a chain reaction of position upgrades and hires predominantly from regional airlines. This impending "tsunami of pilot retirements" is a significant concern as larger carriers are facing increased demand. She highlighted that, while 12 major carriers hired over 13,000 pilots last year, almost entirely from regional airlines, there remains a significant pilot deficit. In 2022, 9,491 pilots qualified, which is notably less than the 13,128 pilots hired by just a fraction of the industry. This shortage is evident: over 500 regional aircraft are grounded, and nearly 72% of all U.S. airports have lost an average of 25% of their flights, impacting smaller airports more severely. As a response, regional airlines are elevating first officer salaries to over $100,000, mirroring those at larger network carriers, yet the pilot shortfall persists.

Pilot shortage statistics

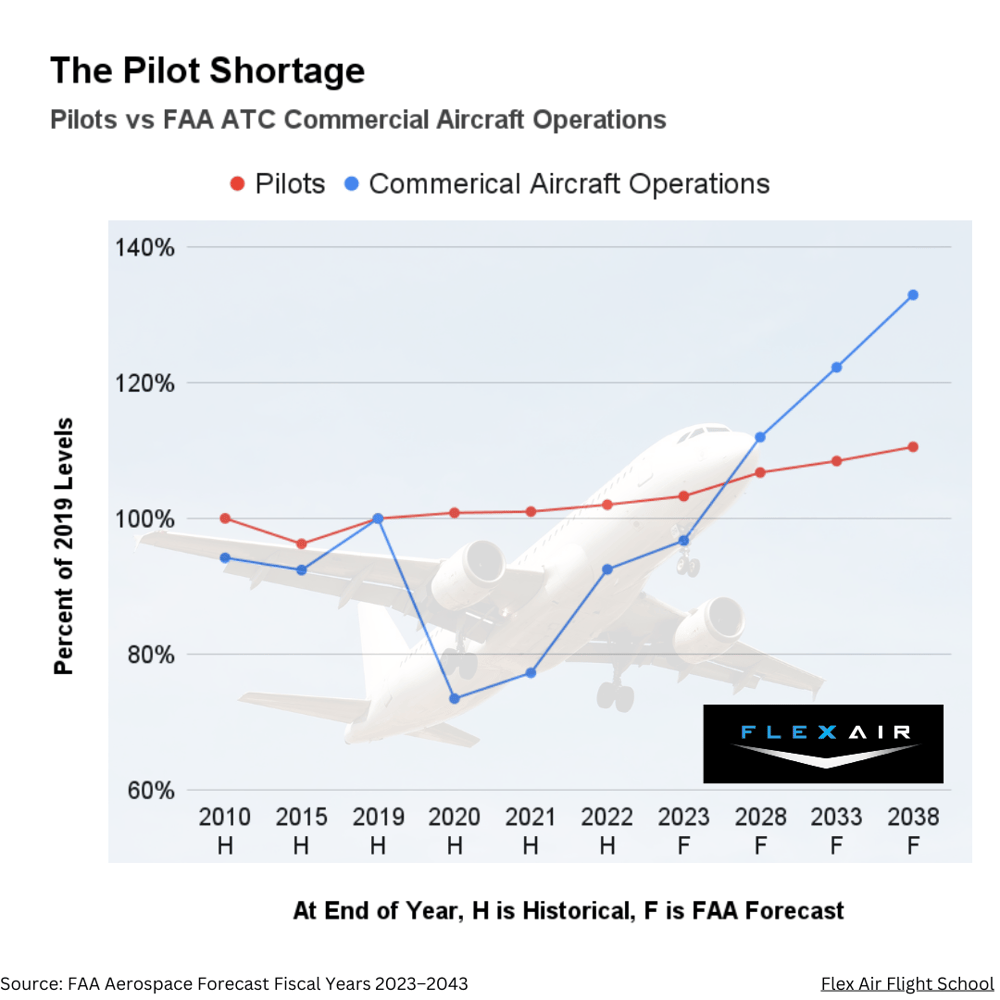

Flex Air used FAA data to do our own analysis as well. Here we compare the increase in pilots (commercial + air transport pilots) to the number of commercial aircraft FAA & contract tower operations, which is a good proxy for the number of commercial flights. As you can see commercial air traffic will grow much more rapidly than the number of pilots.

These forecasts come from the FAA Aerospace Forecast FY 2023–2043, which is a document developed by the Federal Aviation Administration (FAA) to support its budget and planning needs. The forecasts are developed using statistical models to explain and incorporate emerging trends of the different segments of the aviation industry. The latest release is 168 pages long and covers all of aviation, in which they explain all of their assumptions, both optimistic and pessimistic forecasts for air travel. We have selected just the simplest data and base case forecasts to show how the quantity of forecast air traffic is growing much more quickly than the number of pilots.

Here is the data we used:

- The historical and forecast active pilots by type of certificate.

Source: FAA U.S. Civil Airmen Statistics- This tells you how many pilots (with valid FAA medical certificates) there are.

- You can learn more about the differences between commercial pilots and air transport pilots, but all you really need to know is that the the Pilots of Major US carriers are Air Transport Pilots and the Regionals, Charter are generally commercial pilots who will be hired by the majors once they have enough experience and can become Air Transport Pilots.

- The historical and forecast Commercial Aircraft FAA & Contract Tower Operations

Source: FAA Air Traffic Activity.- FAA contract towers are air traffic control towers providing air traffic control services under contract with the FAA, staffed by contracted air traffic control specialists.

- You can think of an Commercial Aircraft Tower operation as a proxy for the number of commercial flights. This metric is preferable to passenger miles or enplanements because it eliminates the need to worry about the changes in aircraft passenger capacity.

- We are excluding all General Aviation, this likely UNDERSTATES the total number of flights flown by commercial pilots who are flying private aircraft for hire but may be marked as General Aviation.

|

FAA Pilot Data and Forecast |

FAA ATC Data and Forecast |

|||

|

Fiscal Year |

Commercial Pilots |

Air Transport Pilots |

Air Carrier ATC Operations |

Air Taxi / Commuter ATC Operations |

|

2010 H |

123,705 |

142,198 |

12,658,000 |

9,410,000 |

|

2015 H |

101,164 |

154,730 |

13,755,000 |

7,895,000 |

|

2019 H |

100,863 |

164,947 |

16,192,000 |

7,234,000 |

|

2020 H |

103,879 |

164,193 |

11,737,000 |

5,472,000 |

|

2021 H |

104,610 |

163,934 |

12,214,000 |

5,885,000 |

|

2022 H |

104,498 |

166,738 |

15,150,000 |

6,522,000 |

|

2023 F |

104,700 |

169,900 |

16,626,000 |

6,040,000 |

|

2028 F |

105,050 |

178,800 |

20,164,000 |

6,073,000 |

|

2033 F |

104,950 |

183,400 |

22,248,000 |

6,401,000 |

|

2038 F |

104,700 |

189,200 |

24,408,000 |

6,742,000 |

Years marked H are Historical

Sources: FAA U.S. Civil Airmen Statistics & FAA Air Traffic Activity.

Years marked F are Forecast

Source: FAA Aerospace Forecast FY 2023–2043

To make the picture clearer, we’ve summed the pilots by year and the ATC operations by year, and represented everything as a percentage of 2019 totals. Obviously 2020-2022 were disrupted by the COVID-19 Pandemic, but you can clearly see that air traffic has rebounded and will continue to grow much faster than pilots.

|

Pilots as % of 2019 |

Comm ATC Aircraft Ops as % of 2019 |

|

|

2010 H |

100% |

94% |

|

2015 H |

96% |

92% |

|

2019 H |

100% |

100% |

|

2020 H |

101% |

73% |

|

2021 H |

101% |

77% |

|

2022 H |

102% |

93% |

|

2023 F |

103% |

97% |

|

2028 F |

107% |

112% |

|

2033 F |

108% |

122% |

|

2038 F |

111% |

133% |

How Big is the Pilot Shortage

Oliver Wyman is a global management consulting firm specializing in strategy, operations, risk management, it's a part of Marsh & McLennan Companies and serves a variety of sectors including the aviation Industry along with financial services and retail. The firm is widely recognized for its deep industry knowledge and quantitative analysis.

Pilot Demand: Will there be enough new pilots?

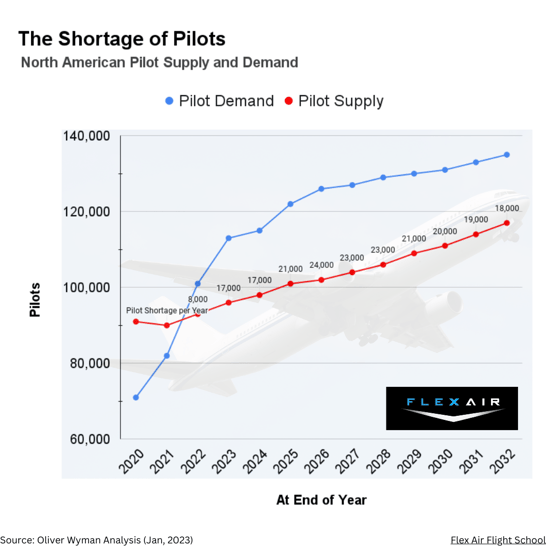

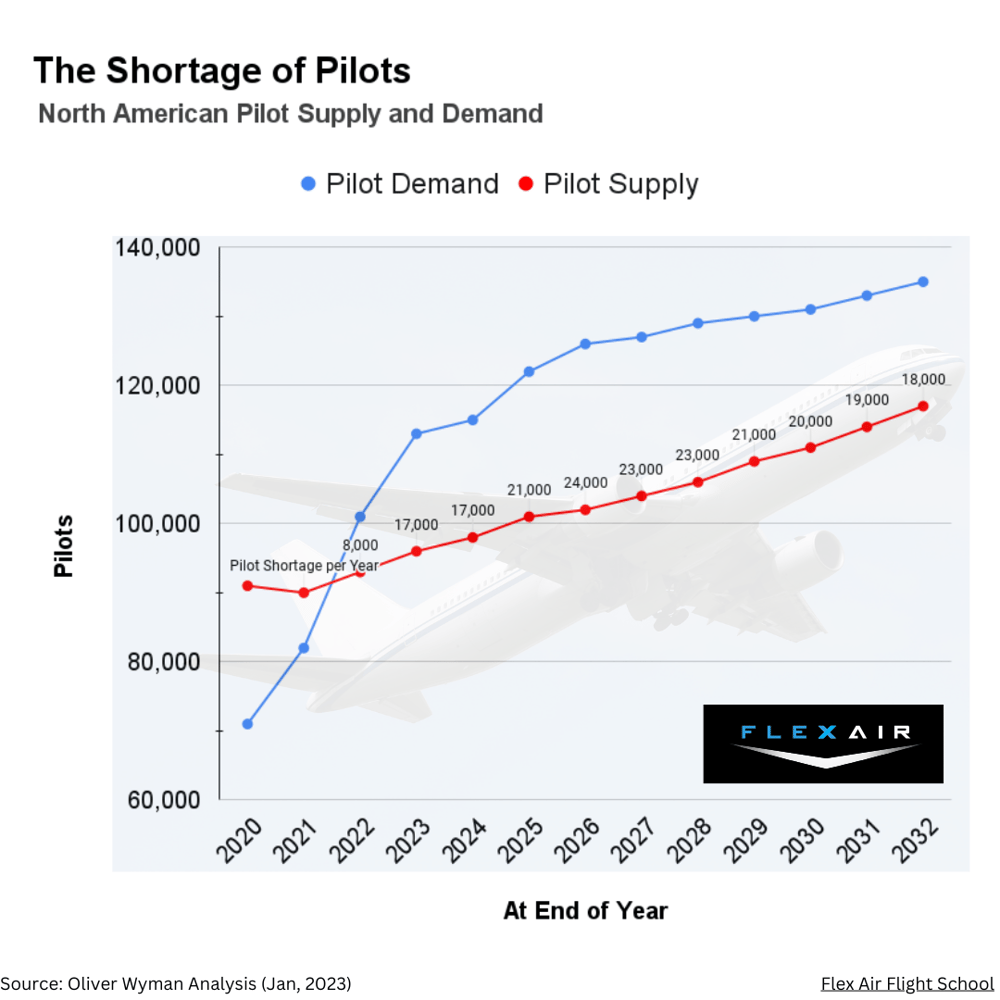

A 2022 Oliver Wyman analysis predicted a gap between supply and demand of nearly 30,000 pilots in 2032, which would have been catastrophic. In January 2023 they revised their forecast to show a smaller but still severe shortfall of 17,000 at the end of the next decade. That’s the current gap as well, but the supply and demand is expected to get worse in 2026 with a gap of 24,000 pilots, before it trends back to the current shortfall over the remaining years.

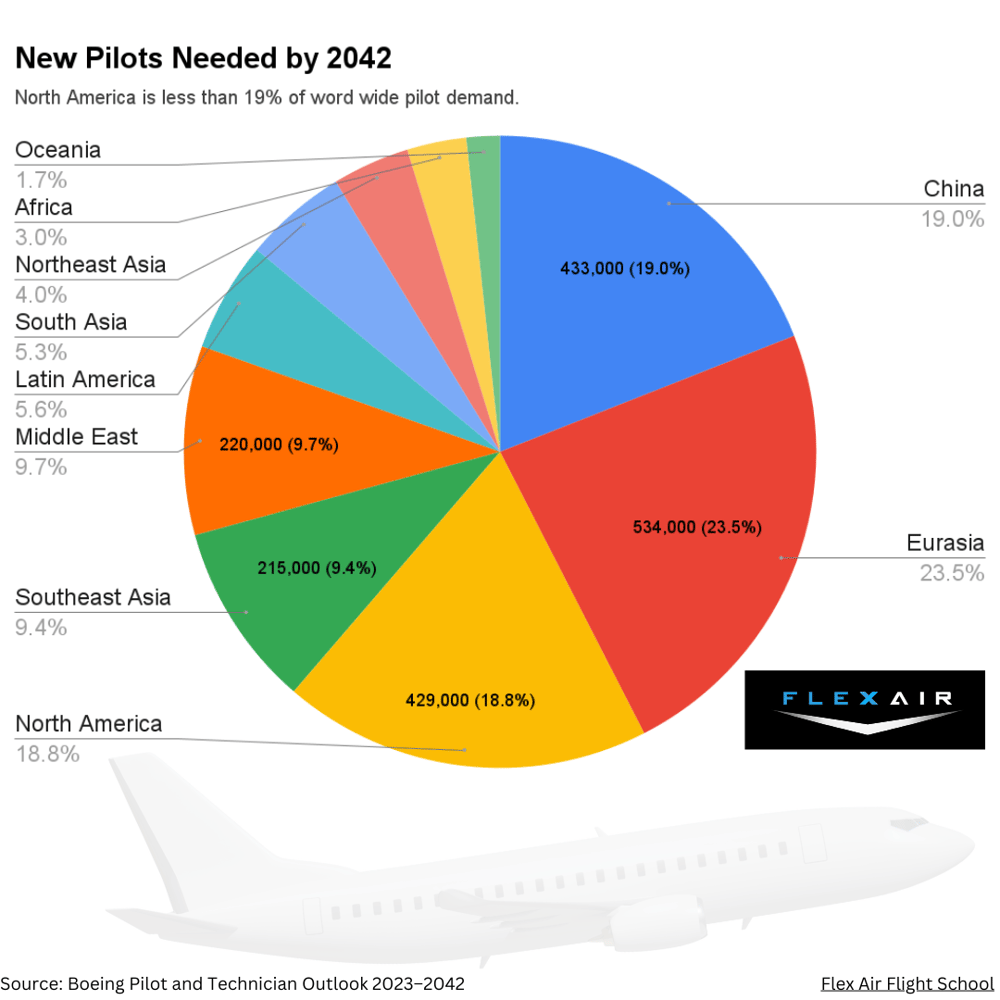

Of course that is just the North American picture, and North America only represents less than 19% of the forecast pilot demand.

When will the airline pilot shortage end?

The FAA data Flex Air used in its analysis only goes to 2038, and it shows the shortage to be at its worst in 2038.

Oliver Wyman thinks the pilot shortage is going to get worse before it returns to being as bad as it is today. They don’t forecast a reduction in the shortage in the next decade, which is as far as the forecast.

Boeing’s data goes to 2042 and shows a continuing shortage the entire time.

What are the reasons for the pilot shortage?

The aviation industry, recovering from the impacts of the COVID-19 pandemic, has begun a period of significant growth and expansion.

1. The Pandemic and its Impact on Aviation

The COVID-19 pandemic severely affected the aviation industry. Staffing became a major hurdle, especially for regional carriers. The pandemic caused significant bottlenecks in hiring and training, leading to staff shortages across roles, including pilots and maintenance crews. These staffing challenges resulted in increased airfares and created a backlog that might persist for up to five years or more. Regional carriers, especially, felt the pinch with a drop in domestic capacity. Moreover, as demand shifted and major airlines started hiring again, they drew from the regional pilot pool, exacerbating the pilot deficit at regional airlines.

2. Expansion of the Aviation Industry

Despite the setbacks, the aviation sector is witnessing unprecedented expansion:

- Mainline Carrier Fleet: Predicted to grow from 3,915 jets in 2022 to 5,925 by 2043.

- Regional Carrier Fleet: Anticipated to rise from 2,002 aircraft in 2022 to 2,387 by 2043, with a notable transition from 50-seat regional jets to 70-90 seat jets.

- Cargo Carrier Fleet: Expected to double, reaching 1,974 by 2043, up from 935 in 2022.

This growth inevitably brings an increased demand for pilots and other aviation personnel.

3. Pilot Demand & Regional Dynamics

Globally, 25% of the commercial pilot workforce will retire within the next decade. A whopping 649,000 pilots will be required over the next twenty years to support the global fleet. Regional forecasts for new pilots from 2023-2042 show that areas like Asia-Pacific, Eurasia, North America, and the Middle East will be the most significant contributors to this demand. However, regions like Southeast Asia, Africa, and South Asia are exhibiting the fastest growth in personnel demand.

4. Economic and Environmental Considerations

The global economy showed signs of slowing down in 2023, but air transport continued its optimistic trajectory. The industry aims for net-zero emissions by 2050, further complicating the landscape. The demand for air travel is expected to double by 2040, which suggests a significant rise in required flights and, subsequently, pilots. Financially, North America leads in profitability, followed by Europe, while Asia Pacific presents potential growth opportunities.

Considering a Pilot Career?

Accelerated flight training program can be a great option for those looking to become an airline pilot. It is a demanding program but it is the shortest path to an aviation career as a commercial pilot. If the rewards and challenges are interesting we'd love to help you learn how you can take advantage of the pilot shortage and help meet the growing demand for air travel. Learn more about the Flex Air Pilot Pathway program.

Attempts to Address the Pilot Shortage

Airlines are grappling with limited training capacities, and the time it takes to onboard new personnel has broadened the personnel gap. Some airlines have begun investing in early career programs and outreach initiatives, however they simply have not been able to ramp up sufficiently. This is due in part to the high debt levels airlines took on during the pandemic, but there are larger demographic shifts at work.

- The baby boomers are retiring, and the next generations are simply smaller.

- The military has a shortage of pilots as well, and retiring military pilots have been a traditional source of airline pilots.oo

- The military is transitioning to less aircraft overall, which means less pilots for the airlines.

- The global demand for air travel is growing more rapidly than the population.

- The FAA “1500 Rule” has increased the flight hours required to become an Air Transport Pilot, making the pilot training pipeline longer and more expensive for all student pilots.

Airlines are shifting their fleet composition to carry marginally more passengers per plane. They have lobbied congress to raise the maximum retirement age, without success. There has been consistent chatter about trying to reduce the number of pilots required on long haul flights, but safety concerns have prevented any action.

Why can’t existing pilots just fly more?

Existing pilots cannot simply fly more to address the pilot shortage due to strict regulations that limit their flight hours. In the U.S., the Federal Aviation Regulations (FARs) cap pilots at 1,000 flight hours in a 365-day calendar period. Similarly, while European pilots under the European Union Aviation Safety Agency (EASA) Regulation 83/2014 can also fly up to 1,000 hours within 12 consecutive calendar months, they are limited to 900 flight hours in a calendar year. These restrictions aim to ensure pilot safety and prevent fatigue, which is why airlines are mandated to conduct fatigue management courses as part of their legal operating certificates.

How is the pilot shortage affecting pilot salary and compensation?

The ongoing pilot shortage has created a highly competitive job market for qualified pilots, leading to increased wages and signing bonuses. Regional airlines, in particular, have been offering generous compensation packages to attract pilots and fill their ranks. Many regional airlines are now offering first officer salaries in excess of $100,000 a year, making them competitive with the major carriers. The expanding gap between supply and demand is forcing airlines to compete with one another for pilots through higher compensation. Recent contract negotiations are pushing up pilot salaries at almost all the airlines.

Flex Air’s students graduate into a rapidly changing air transport industry. We place pilots directly into regional airline operators. Regional airlines recovered first during the Covid-19 crisis because they operated fleets of smaller aircraft that better served the fluctuating demand that characterized the initial phases of the economic recovery. Regional airlines were also minimally exposed to the hardest-hit international routes during the Covid crisis. In Q1 2023 and 2020, Flex Air’s Regional Airline Outlook surveyed industry-wide pay trends for First Officers and Captains.

Overall, regional airline pay was up by 50% - 100% since our previous 2020 survey. We anticipate that these pay rates will continue increasing in the long term as regional airlines compete for a smaller pool of entry-level First Officers. Over 6,000 pilots retire from the U.S. air transport pilot community each year as the Baby Boomer generation ages out of the workforce. Mainline carriers have established a practice of “poaching” senior Year 2 and 3 pilots from regional airlines, which means that retirements will affect the entire industry from top to bottom. We assess that demand for air travel, demographics, and diminishing supply of both civilian and military pilots will cause this critical shortage of pilots to be felt even in entry-level positions, with increases in wages and benefits continuing through 2035.

Aspiring Pilot? Become a commercial pilot.

Accelerated flight training programs, like the Flex Air Pilot Pathway program, offer a comprehensive approach, enabling students to secure all necessary licenses within 10-12 months. If you are interested in becoming a professional pilot or just flying for fun, reach out and we'd love to get to in the air!

Sources: