Flex Air offers a number of Flight Training Financing options, but we are not part of the Sallie Mae program. We've applied to be included in the Sallie Mae network a few times, but never heard back.

Sometimes our prospective students complain that the Sallie Mae rates are so much lower. If you're a prospective aviator who shops SOLELY based on interest rates, this blog post is a love letter to you.

I applied for a flight school loan to learn more about what's going on with Sallie Mae. I'm a retired naval aviator with an MBA. Before I decided to become an entrepreneur, I worked at Boeing. I'm married, own my own home, I have savings and investments and I own and operate Flex Air Flight School as the sole owner. I have excellent credit. So I probably got a pretty good rate... or did I? Read on to see the gory details.

First, we need to clear up a misconception about Sallie Mae.

Sallie Mae is not a government entity. This common misconception may come from the fact that it WAS a government entity set up to service federal education loans, but today it is SLM Corporation, a for profit company, publicly traded company. This means that loans from Sallie Mae are not federal student loans and lack the protections and benefits associated with them. For those applying for flight school loans, it's crucial to understand that Sallie Mae's private loans come with terms, interest rates, and repayment options determined by the company, independent of federal loan regulations.

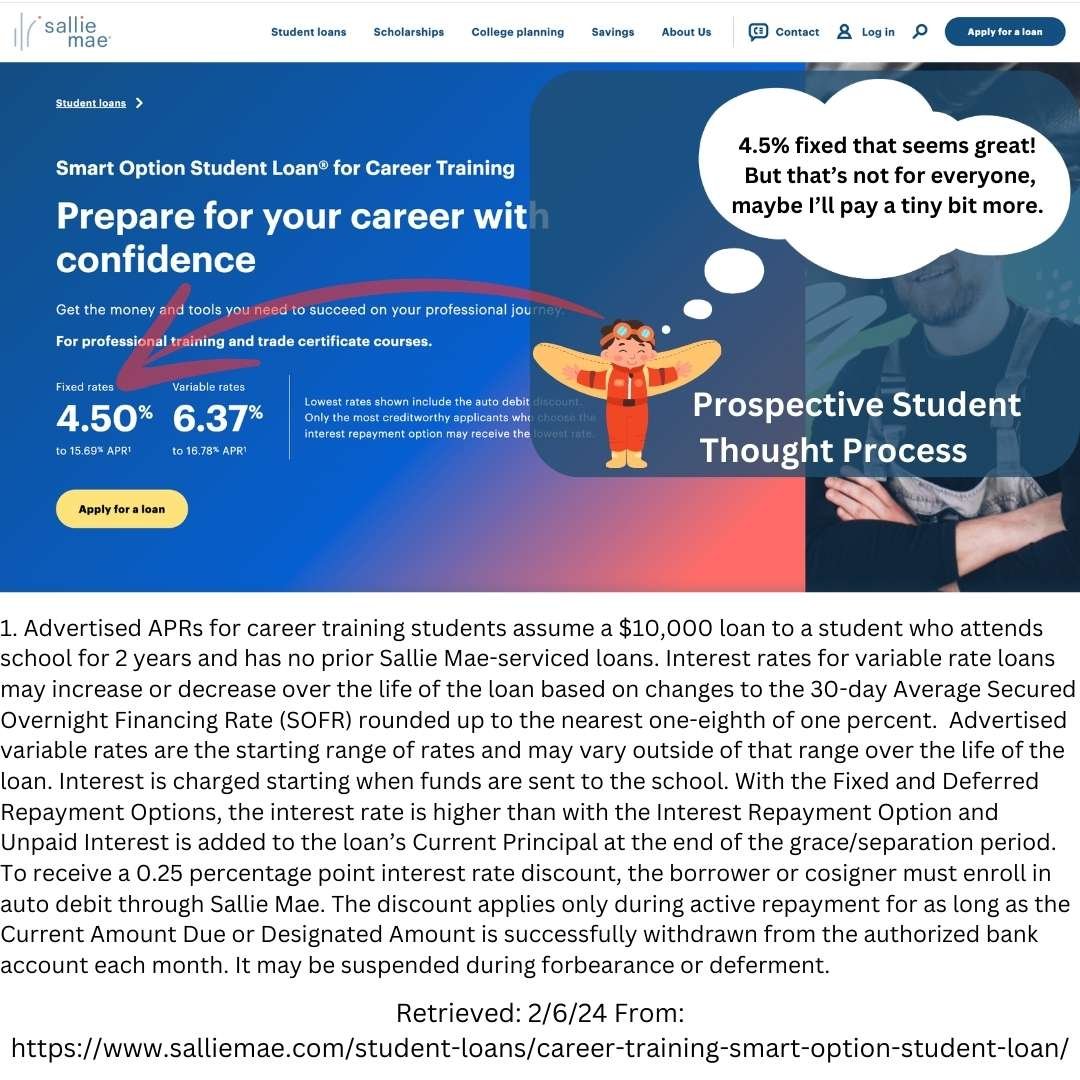

"But, Sallie Mae has a 4.5% Flight School Loan"

Let's take look at their Career Training page and how we think some prospective students may see it...

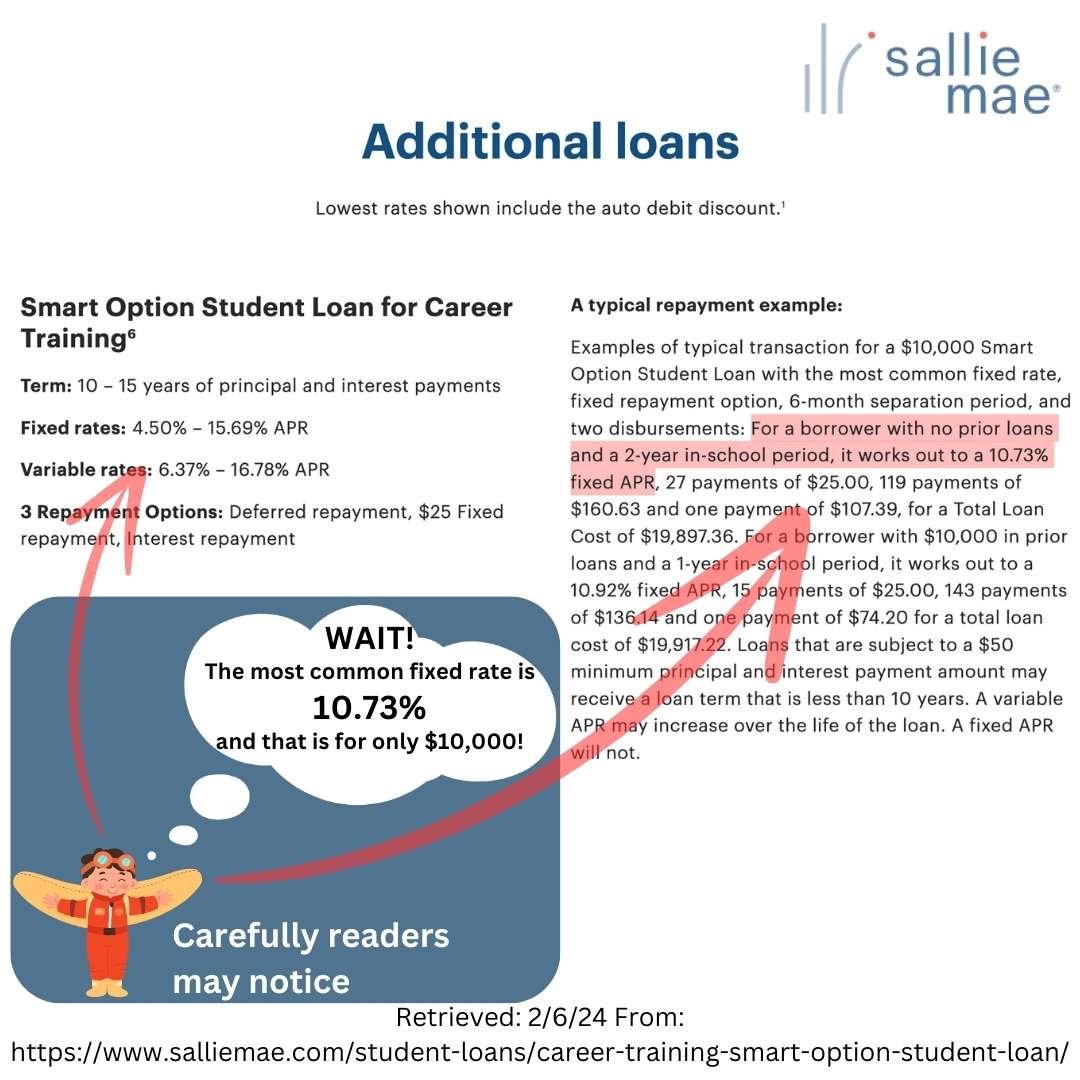

That rate is only for the VERY BEST borrower and it is only for $10,000, It is very hard to imagine that anybody gets that rate for a $100,000 loan to pay for flight school.

That rate is only for the VERY BEST borrower and it is only for $10,000, It is very hard to imagine that anybody gets that rate for a $100,000 loan to pay for flight school.

Selective Advertising and Psychological Impact: Lenders often use the lowest available rates in their advertising to make their loan products seem more attractive. This is a common marketing tactic but can create unrealistic expectations for borrowers. It speaks to the psychological phenomenon called "anchoring," where the first piece of information offered (in this case, the low rate) influences decision-making and expectations, even if those expectations may be unrealistic for most consumers.

Rate Ranges: Lenders often advertise a range of possible interest rates, from the lowest to the highest they offer. The actual rate you receive will depend on your creditworthiness, which includes factors like your credit score, credit history, income, and sometimes, the creditworthiness of a cosigner. For more specialized loans, like those for flight school, the underwriting criteria can be even more stringent, owing to the high cost of flight training and the specialized nature of the career path.

So Maybe you dig a little deep on the Sallie Mae Loans page find the details for the career training loans. Sallie Mae is advertising for Flight School loans, as I write this on 2/6/2024, and labeled "Information advertised valid as of 1/25/2024."

As I said before, I'm a retired naval aviator. I'm married and own my own home. I have savings and investments and own and operate a Flight School. I have very good credit.

As I said before, I'm a retired naval aviator. I'm married and own my own home. I have savings and investments and own and operate a Flight School. I have very good credit.

So, I applied for a Sallie Mae Flight School Loan. Sallie Mae which advertises a fixed Rate loans "as low as 4.5%". That seems like a pretty great deal, I mean the US Government is paying about 4.1% to for a 10 year loan right now. You can see that by looking at today's 10 Year Treasuries (those are 10 year loans to the federal government) in the chart to the right.

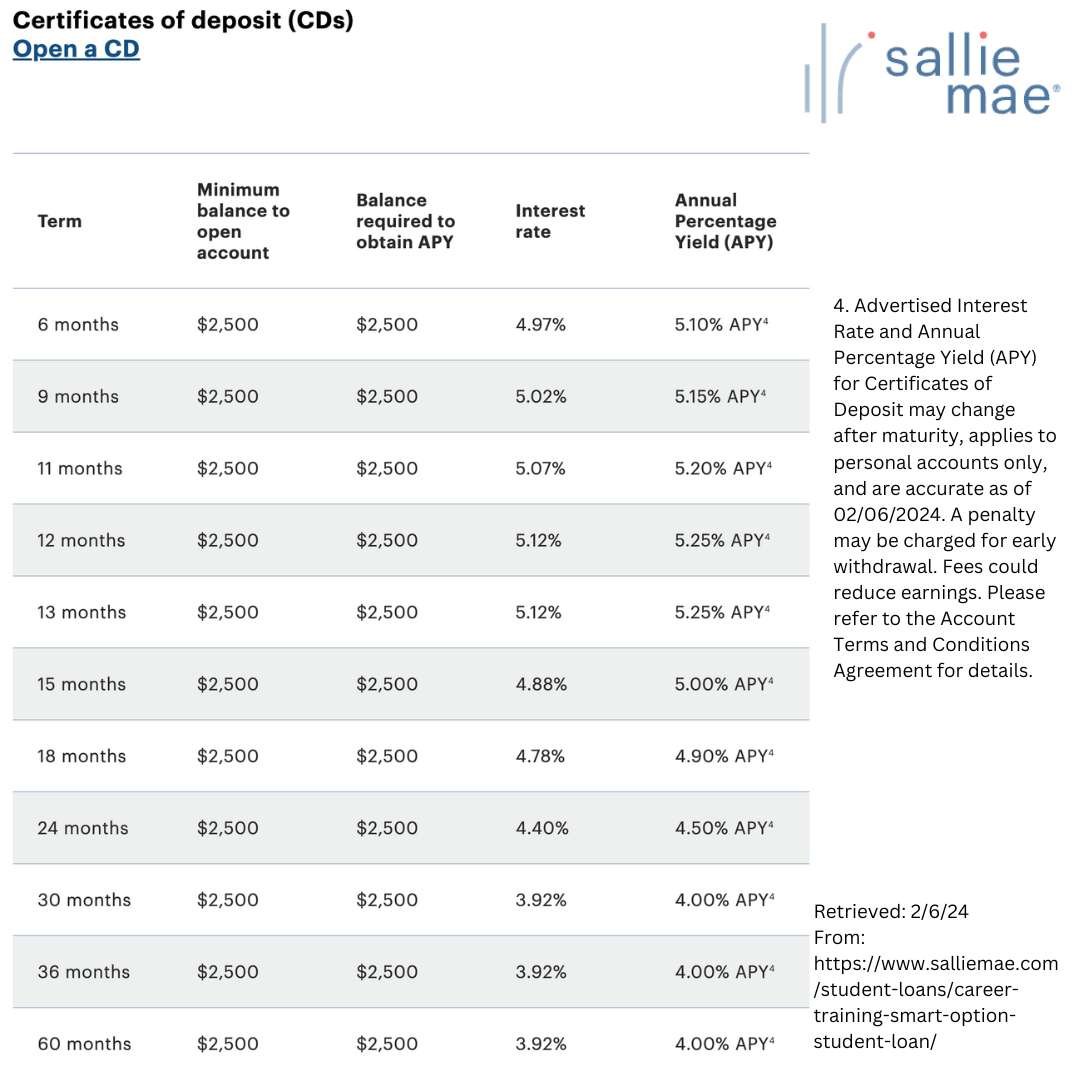

But before we get to my loan, let's also look at how much is Sallie Mae paying to borrow money. The money they lend student isn't their money, they borrow it, so let's take a look at their CD rates, that's one way they borrow money so we can see what they pay as of today (2/6/24) from https://www.salliemae.com/banking/rate-table/

This means Sallie Mae is paying around 4-5% to borrow money depending on the term.

This means Sallie Mae is paying around 4-5% to borrow money depending on the term.

After I retired as a naval aviator and before I decided to co-found a flight school, I worked on engineering projects at Boeing. One of the truisms from aerospace engineering is, "There ain't no such thing as a free lunch" (TANSTAAFL).

You may be wondering, how can Sallie Mae make any money if they borrow at the same rate they loan money at? THEY CAN'T! Because TANSTAAFL.

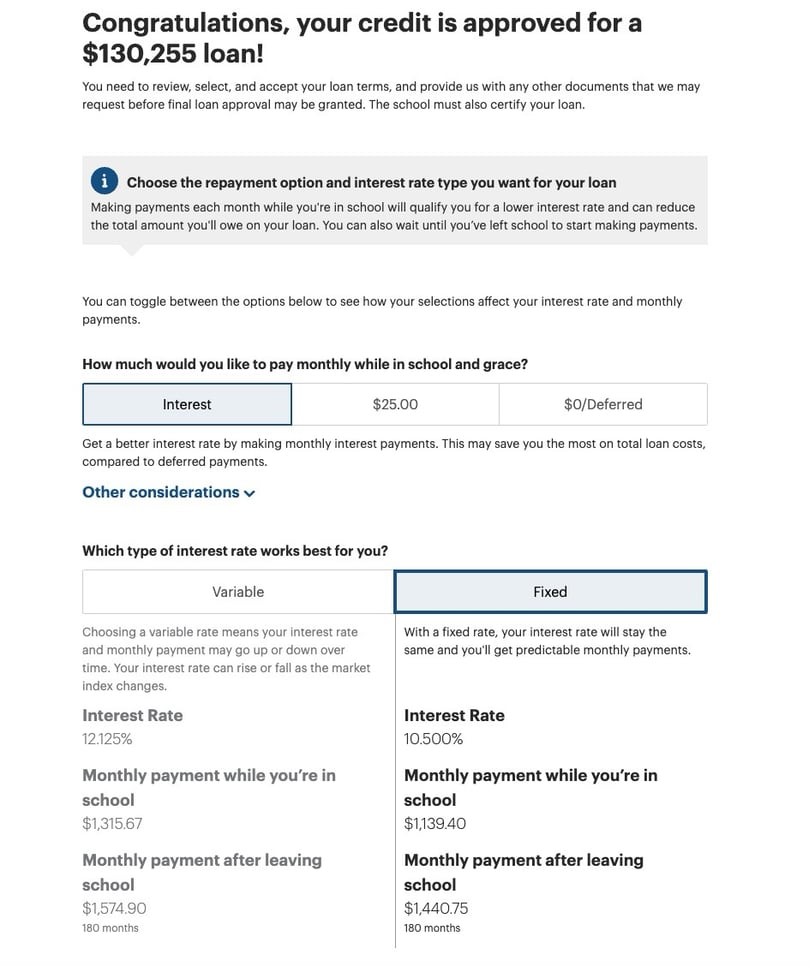

My Rate for Sallie Mae Student Loans for Flight School?

It turns out I am a great loan candidate, I applied for a large loan, enough that anybody be able to pay for flight school (even at a more expensive option than Flex Air) and have some money for materials, plus a living stipend. I got a fixed rate loan offer for 10.5% or a variable loan of 12.125% This is with no deferred payments, meaning that loan payments begin right away, keep reading for the other options.

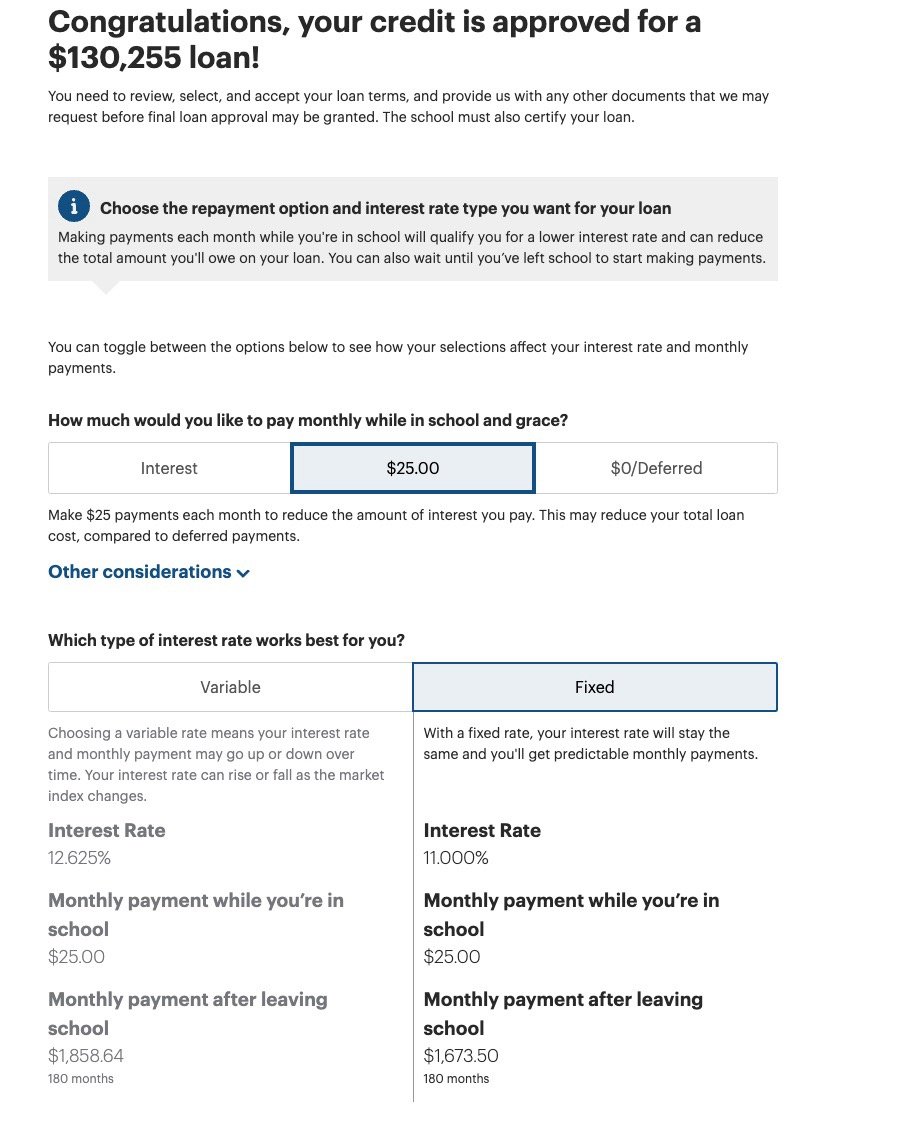

Sallie Mae Flight School Loan with $25 Payments

If I were to pay just $25 / month while doing flight training the Sallie Mae loan rate is 11% fixed rate or 12.625 variable rate.

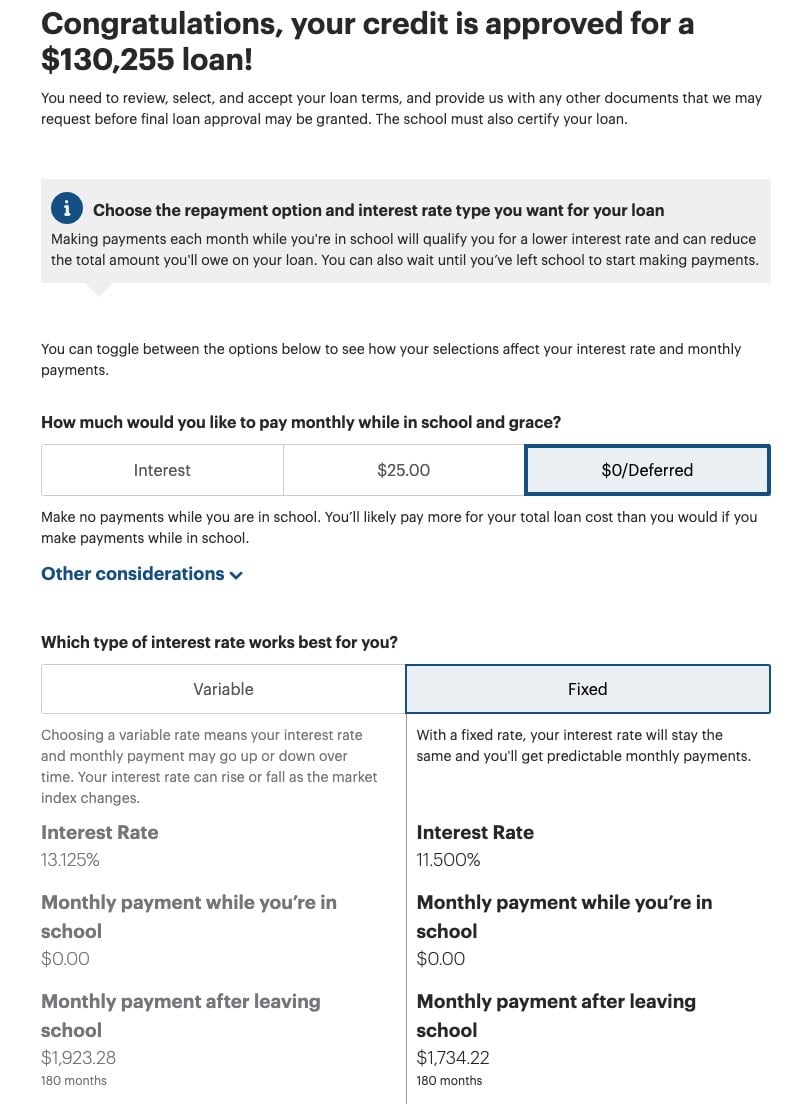

If I only pay for flight school after graduating...

To defer all payments until the end of school, the rate has gone up another .5% to 11.5% for a fixed rate loan, or 13.125% for a variable rate loan.

Private Student Loans for Flight Training

The loan business is competitive, and while it makes sense to shop for a loan make sure you are comparing a real offer, not a "as low as rate" that you will never get. Sallie Mae is a perfectly good source of financing for your pilot training, but they don't have loans that are magically way cheaper than everybody else.

Choose a flight school because it's a good flight school, with great instructors, great mentorship, and a track record of great career outcomes for people like you. Look at more than just interest rates. And if you do look at interest rates, make sure they're real. Any reputable loan provider will allow you to apply with no fee or no obligation. Take advantage of this and shop around.

Q: How much does flight school cost and are there financing options available?

A: The cost of flight school can vary greatly depending on the program and the school. Generally, it can range from $5,000 to over $115,000. There are several financing options available including federal student loans, unsubsidized loans, and private loans like the Sallie Mae Smart Option Student Loan. There may also be scholarships or financial aid options available depending on your circumstances.

Q: What does the financing process for pilot training involve?

A: The financing process for pilot training could involve applying for different types of financial aid like the Free Application for Federal Student Aid (FAFSA), checking student loan options and applying for loans once you have determined your financial need. Other options like the Sallie Mae Smart Option Student Loan may also be available.

Q: What is the Sallie Mae Flight School Loan and how does it compare to other training financing options?

A: The Sallie Mae Flight School Loan is a private loan option for those attending an accredited flight school. It is one of the few loan options specifically designed for flight training. Unlike federal loans, it can cover up to 100% of the school-certified cost. The interest rate and repayment terms can differ from federal student loans, so it's crucial to understand the terms before applying.

Q: Does Sallie Mae offer loans to finance aviation school?

A: Yes, Sallie Mae does offer loans to help finance the cost of attending an aviation school. The Sallie Mae Flight School Loan can cover up to 100% of the school-certified cost.

Q: Can federal financial aid be used for flight school financing?

A: Federal financial aid, including subsidized and unsubsidized loans, can be used to help finance flight training programs, but only if you’re attending an accredited flight school. If the school is accredited, then you can apply for federal financial aid through the Free Application for Federal Student Aid (FAFSA).

Q: Are there alternatives for flight school financing if I'm not eligible for federal student loans?

A: Yes, if you're not eligible for federal student loans, there are alternatives for flight school financing. These can include private loans, like the Sallie Mae Flight School Loan, and scholarships. It's important to research all options and understand the terms and conditions before making a decision.

Q: What are some student loan options for becoming an airline pilot?

A: Several student loan options can help finance training to become an airline pilot. Federal student loans can be an option if your flight school is accredited. For private loans, the Sallie Mae Flight School Loan is one option. Scholarships and financial aid packages may also be available. Always consider all your options before making your choice.

Q: How does financing for an aviation training program work?

A: Financing for an aviation training program can use both federal and private loan options. Apply for financial aid, and once you get an understanding of your financial need, explore loan options. Different loans can be used to cover various school costs like tuition, equipment, and room and board.

Q: Are there loan alternatives for flight school if I don't qualify for the Sallie Mae Flight School Loan?

A: Yes, even if you don’t qualify for the Sallie Mae Flight School Loan, there are other options. These include federal student loans, other private loan options, and scholarships. Also, some flight schools may offer payment plans or discounts, which are worth exploring.

Q: Can I use the federal PLUS loan for paying for aviation school?

A: Yes, a federal PLUS loan can be used to finance education expenses not covered by other financial aid. This could include costs associated with aviation school. However, take note that the eligibility for a PLUS loan relies on a credit check, and the loans often have a higher interest rate than other federal loans.